Cutting-edge PVM Analysis

Proprietary profit attribution model for large-cap manufacturing and consumer goods finance teams

As seen on Secret CFO, trusted by +50,000 finance leaders.

What if you could more precisely understand your financial performance?

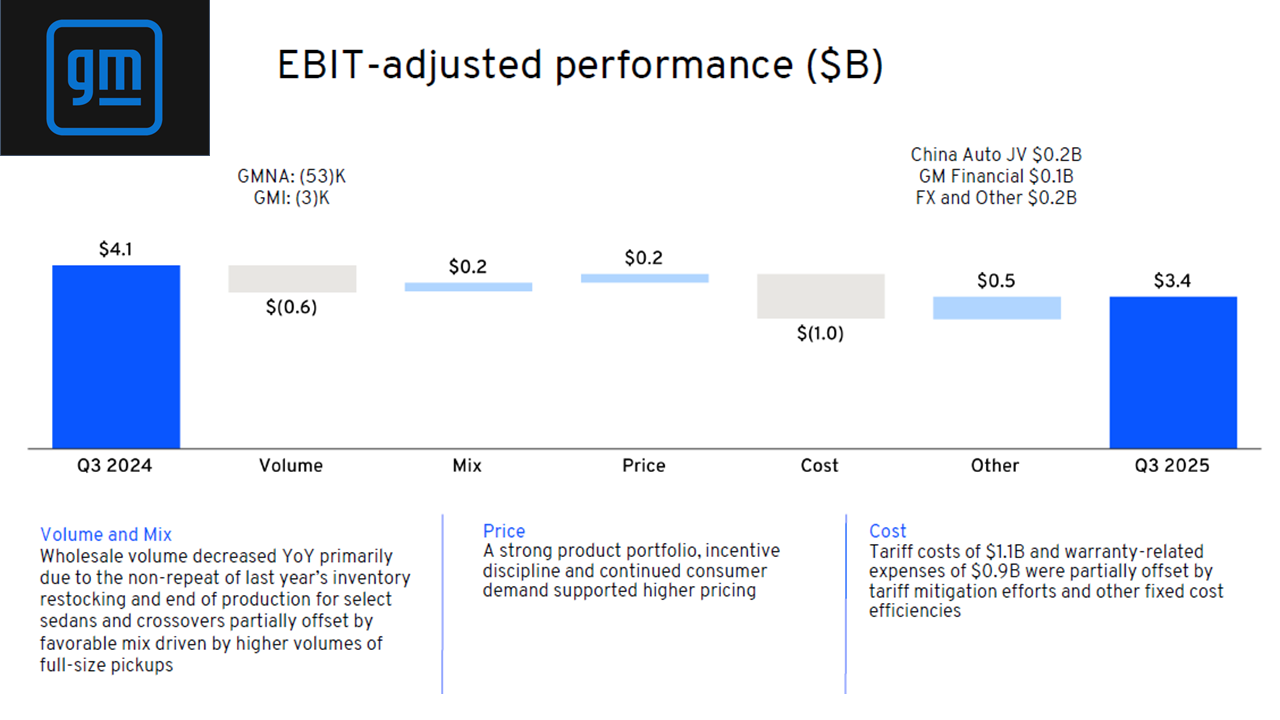

According to PwC, 70% of leaders overlook meaningful insight hiding in their existing financial data. CFOs of Fortune 500 companies like GM and Conagra widely use margin waterfalls to understand their profit narrative and make operational decisions. But until now, these models couldn’t quantify crucial changes in:

Sales channel mix

Factory of origin mix

Customer demographic mix

Product mix

Sales region mix

Business unit mix

And many other vital profitability levers

A research-backed framework

“The preferred method for analyzing profitability is a bridge analysis, which is also known as a price waterfall or ‘price, volume, mix’ analysis.”

Increase Revenue and Maximize Profit by Capitalizing on Pricing Analytics“A properly structured PVM analysis enables FP&A leaders to provide a comprehensive perspective on historical results and actionable intelligence to prescribe key business improvements.”

A Quantifiable Approach To Price Volume Mix Analysis

“Unsound decisions erode, on average, about 3% of EBITDA... get AI working on complex, challenging problems… accelerate AI development in profit variability analysis (highest ROI use of AI).”

Top 3 Strategic Priorities for FP&A Leaders 2025Engineered for ROI

Uncover hidden insights using a recommended framework engineered to new limits. The only commercially available profit attribution model to:

Be built on a widely adopted and familiar framework.

Require only your existing financial data.

Unlock highly-granular and mathematically valid non-linear profit attribution that doesn’t oversimplify your enterprise.

Decompose the “mix” category to subcomponents that reveal vital profit levers often undiagnosed due to offsetting effects.

Be fully automated, allowing your team to focus on driving business excellence instead of data management.

“Thanks to Margineo, we have a fundamentally better understanding of our business and how to optimize growth going forward.”

CFO of +$100M manufacturer after Margineo’s proprietary profit attribution model unlocked +50bps of profit opportunity.

FAQs

-

We are currently working with a cohort of beta customers before widely releasing our product. Contact us to determine whether your company is eligible to try Margineo’s PVM Analyzer.

-

Though we are not going to release the mathematics behind our proprietary model, here is what we can share.

Margineo quantifies and explains key profitability drivers across volume changes, price/cost structure changes (including foreign currencies) and multi-dimensional mix interactions (product, consumer, geographical etc.) using proprietary technology and machine-learning based computational techniques.

Our model is built atop the highly recommended PVM framework but engineered to a new level of utility.

-

We currently operate as a consultancy to maintain a higher level of control over our technology and customer experience. Since our algorithm is 100% software based, we are working on an enterprise ready desktop application that will be released in the future.

We can currently build and present a full profit report within 72 hours of receiving the required financial data. The data requirements are as follows and follow a typical income statement structure:

Data Format: csv or excel table

Table Metadata:

Category data (1-5 columns) reflecting the various mixes to analyze (e.g. Product, Sales region, Factory of origin, Business unit etc.)

P&L line item category (e.g. revenue vs COGS)

(optional) P&L sub-line item (e.g. selling price, discount, raw material cost, labor cost, logistics cost, etc.)

(optional) Currency - Margineo will assume USD unless otherwise noted.

Table Values:

Sales volume for baseline period

USD per unit for baseline period

Sales volume for evaluation period

USD per unit for evaluation period

As an early stage company, we wish to remain flexible to the security methods that you may propose, including working entirely on premises or via remote desktop/VPN access, to ensure all data remains under your control. We follow the advisory industry’s best practices with data in transit and at rest. Our virtual data room is a GDPR, SOC 2 Type II, ISO 27001, and ISO 27701 compliant file sharing system trusted by enterprises and governments, including RSM Global, a leader in enterprise consulting and auditing. We always use SSL/TLS and AES 256-bit encryption to keep files secure in transit and in storage. We tightly control access and authenticate with MFA and keep a secure audit log in the data room.

Building the leading PVM model

Artur Jacques

Finance-wiz and self-taught programmer Artur Jacques began working for a New York investment banking firm at age 15. After graduating from university, he moved to Silicon Valley to join Tesla’s elite FP&A team at the Fremont factory (the most productive automotive plant in North America). In his last role, he led Tesla’s entire global manufacturing and supply chain forecasting process after a battlefield promotion. A serial entrepreneur in pursuit of a new challenge, he left Tesla and started Margineo.

Primarily located in Dallas and New York CityFounder and Chief Executive Officer

Ari Seth

Ari Seth began programming at age 12 and sold his first mobile app while still in high school. After working for various corporates and startups as a software engineer, he decided to pursue his PhD in Data Science and Artificial Intelligence. When he is not studying, Ari leads the technological implementation of our ambitious tech roadmap and works on his own engineering hobby projects (if he has the time).

Primarily located in San FranciscoChief Technology Officer

Michael Athanason

Advisory Board Member

Michael Athanson brings a wealth of experience and maturity as a member of Margineo’s advisory board. With over 25 years of valuation and corporate finance advisory experience, his career has taken him across various roles including Managing Partner of Corporate Finance for Ernst & Young and US National Leader of the Alternative Investments Valuation practice at KPMG. A serial entrepreneur himself, Michael now heads his own valuation firm.

Primarily located in New York CitySchedule a 30 minute demo + receive a gift

We look forward to showing you what Margineo can do for your company. When you sign up, we will complimentarily send you “10 Key Lessons from Tesla’s Elite FP&A Team,” our cutting-edge playbook for enterprise FP&A transformation. In it, you’ll get the knowledge to transform your FP&A team from a reactive reporting function to the data-driven strategic nerve of the company it is meant to be. And the best part, it only takes 10 minutes to read!